On 5th February, news broke that Newmont Corp, the world's largest gold mining company, had submitted an all-share offer to acquire Newcrest Mining Ltd in a deal valued at US$16-17 billion. The pro-forma company would be 30% and 70% owned by Newcrest and Newmont shareholders respectively. It is the largest transaction announced in the mining space so far in 2023 and the largest ever in the gold mining sector.

The bid has since been rejected by Newcrest, saying that it does not represent sufficient value for shareholders, however the door has been left open for a better offer.

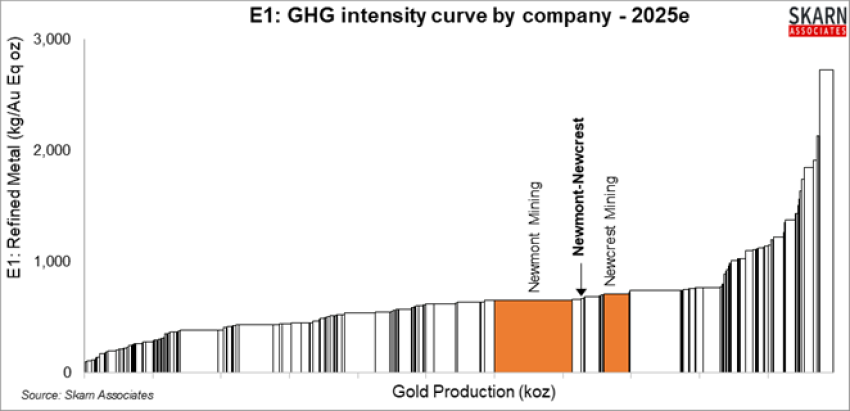

Given the current stand-off between the two gold giants, we were intrigued as to whether this deal would result in a more attractive combined entity in the near term with regards to the big ESG issues - greenhouse gas (GHG) intensity and water use. So, while Newmont's exposure to copper would increase and several potential growth projects would be added to the portfolio, the enlarged Newmont would initially have a higher carbon intensity per ounce produced and a number of water-related challenges.

Both companies sit at the higher end of the gold GHG intensity curve, in the 3rd quartile. Most of Newcrest's energy consumption is electricity-based with Red Chris and Brucejack connected to hydropower in British Colombia, which helps lower emission intensity.

However, Telfer generates electricity on-site using natural gas while Lihir generates power onsite from fuel oil and geothermal sources. Newcrest's biggest decarbonisation challenge is at Lihir, which accounted for c.32% of the company's emissions in FY22, in part due to its remote location and reliance on fuel oil but also the limited land available for onshore solar and wind at any reasonable scale.

Both companies are currently in the third quartile with regards to GHG emission intensity and have set targets to achieve net zero or be carbon neutral by 2050. In short, achieving net zero and carbon neutrality has the same end result - removing harmful emissions from the earth's atmosphere - but the scale and kind of emissions removed are different.

Newmont has a goal to become carbon neutral, which implies a significant reduction in operational emissions offset by carbon credits and sinks. While Newcrest's goal to be net zero could go beyond this and remove all greenhouse gases emitted from their activities.

Newcrest has set a near term target of 30% reduction in Scope 1 and Scope 2 GHG emissions intensity per tonne of ore milled by 2030, compared to a baseline of FY18 emissions. While Newmont aims to go further by cutting greenhouse gas emissions by 32% for Scope 1 and 2 (and 30% for Scope 3). To back up this target, Newmont became the first mining company to deliver accountability on their 2030 commitment by offering US$ 1 billion of sustainability-linked bonds.

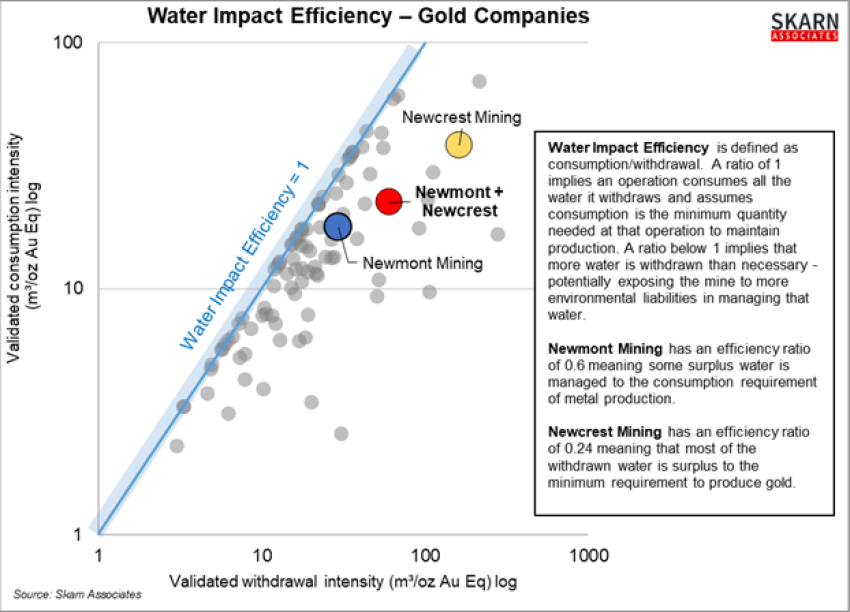

The other big consideration for the deal is around water. Even though Newmont is the bigger gold Newcrest withdraws more water volume from the environment. The main culprit is Lihir, which uses seawater for cooling and tailings dilution, which by itself withdraws more water than all of Newmont's mines.

Newmont and Newcrest operate two gold mines each in Australia, both with very different water issues, which potentially increases the risk on managing water from a Newmont perspective should a deal between the two companies be reached. Newcrest's Telfer mine in Western Australia faces the most extreme climate conditions. Although located in a very dry environment it has experienced several extreme rainfall events over the past two decades resulting in production disruptions due to flooding. These flooding events have the potential to get worse given that the total annual precipitation has increased as well during this timeframe.

From an operational water management point of view, the mine is water positive and generates a substantial water discharge volume resulting in operational dewatering requirements. Telfer's water consumption intensity of over 30 m³/oz Au equivalent, versus an industry average of 16, makes it one of the highest consumers per unit output in the industry.

Newcrest's Cadia Valley (NSW) has a much lower water consumption intensity than Telfer at 12 m³/oz Au equivalent. A notable portion of its water is sourced as municipal wastewater, and the discharge volume is relatively low in comparison. At the same time, there is a significant negative trend in annual precipitation locally, which may lead to a water supply stress in the future.

Newmont's Boddington mine is a high water consumer, with over 24.6 m³/oz Au equivalent of water consumed. It recently started reporting water discharge, which makes it a positive-balance water operation even though overall precipitation levels are declining.

On the plus side, historically the operation has not faced extremely wet months. Newmont's Tanami underground mine has a relatively low water consumption intensity of just over 6 m³/oz Au equivalent with most of its water sourced from groundwater. From a water perspective the Tanami has little exposure to external water conditions.

Across the number of metrics that Skarn employs to analyse water use in mining, the Water Impact Efficiency ratio indicates how far an operation is from the optimum. A ratio of 1, the best possible value, means that an operation consumes all the water it withdraws - assuming that consumption is the minimum quantity needed at that operation to maintain production. A value below 1 implies that more water is being withdrawn than necessary - although this can be intentional, it exposes the operation to more environmental liability in managing that water.

In the case of a successful deal, Newmont would see its ratio deteriorate from 0.60 to 0.38, given Newcrest's arguably poorer ratio of 0.24. Overall this implies that the new company would manage more water and be exposed to increased water related risks, notably from Newcrest's Telfer and Lihir mines with the latter opening up the company to issues on the quality of the water returned as deep sea tailings.

For further information regarding Skarn GHG & Water products please contact:

· markfellows@skarnassociates.com (GHG)

· raymondphilippe@skarnassociates.com (Water)

MORE FROM SKARN

About Us

Skarn Associates is the market leader in quantifying and benchmarking asset-level greenhouse gas emissions, energy intensity, and water use across the mining sector.