Doubtful and delayed were adjectives murmured by delegates at the 15th Fastmarkets Lithium Supply and Battery Raw Materials conference in Henderson, Nevada, in June, rather than direct when referring to the direct lithium extraction (DLE) technologies touted as the means to deliver the lithium the world needs for lithium-ion batteries for electric vehicles and energy storage systems.

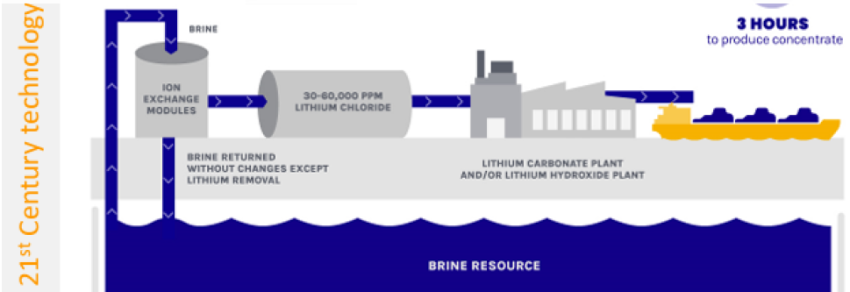

DLE is hailed as the future of lithium brine production due to several advantages over the traditional brine evaporation process. Lithium is recovered using beads, membranes or filters and is much quicker, taking hours rather than the months or years for traditional solar evaporation. DLE operations do not need vast evaporation ponds and would have a much smaller surface footprint, as well as delivering much higher recoveries of 80% compared with 40%. On paper at least.

The conference came a week after Australia’s Lake Resources tempered its decision to jump straight to a 50,000tpa development at its Kachi lithium brine project in Argentina. The developer said production at Kachi, using a Lilac Solutions technology, would see significant delays and cost much more to achieve. First production is now slated for 2030, a six-year delay from the original 2024 guidance.

Around the conference, the chatter was that operating costs would be much higher than project promoters state, no matter the DLE route taken. The principal of a leading engineering firm told Skarn Bulletin that project developments will take longer and cost more because of the impossibility of standardising the equipment. “There is a reason DLE has not been commercially proven yet. You have to create a bespoke solution for each deposit,” they said.

“You have to install a lot of columns to extract the lithium, which increases the capex and means developers are looking at second quartile operating costs rather than the first quartile many claim,” an industry analyst told Skarn Bulletin.

Cristobal Garcia-Huidobro, Chief Executive of Lithium Power International, which has a project on the Maricunga salar in Chile, identified some of the DLE challenges. “DLE uses three times more water, has higher energy usage, and reinjection [of the spent brines] will affect the neighbours’ resources due to fractionated ownership of the salar, which needs regulations to regulate,” he said.

The scepticism around DLE saw many delegates roll their eyes about the announcement that Chinese battery giant CATL, which has no DLE experience, is to invest US$1.4 billion to help develop Bolivia's lithium brine resources, which have very high levels of impurities such as magnesium and sulphate. Bolivia’s President, Luis Arce, said the idea is to build two 25,000tpa lithium plants to extract minerals from the Uyuni and Oruro salt flats.

Contenders

Several DLE candidates were on display at the event. Jordan Taylor, VP of Lithium Operations at Compass Minerals spoke of the Odgen lithium project on Great Salt Lake in Utah, USA. The company has offtake agreements with LG and Ford, and received strategic investment from Koch Minerals in 2022. “Completion and scale of the DLE unit is next step, which we aim to complete by the end of 2023,” he said. Compass aims to use hot water as the lithium stripping agent rather than acids and bases. Its advantage is 50 years experience producing sodium, potassium and magnesium from the lake.

Robert Mintak, President & CEO of Standard Lithium said its DLE demonstration plant on the Smackover Formation in Arkansas has been operating for the last three years and has a feasibility study due in a matter of weeks for a 50,000tpa operation. It is looking to scale operations by 60x from its demonstration plant, with a final investment decision possible in the December quarter. It is also working with Koch as well as, Lanxess, a large brine operator which has the infrastructure that Standard will use.

Steve Hanson, chief executive of ACME Lithium thought about DLE for its Clayton Valley project in Nevada, but seems content to leave that development to someone else. “Ultimately, we will see a large DLE plant in the valley, shared by several producers. The best scenario for the valley is a consortium working together for DLE,” he told delegates.

Making spec

DLE developers (as well as evaporation and spodumene lithium producers) also have to contend with lithium consumers becoming increasingly picky and demanding ever tighter product specification tolerances as the cost of product failure increases. A lithium battery fire, and the need to recall thousands of EVs, is both expensive and damaging to automotive company brands as they work to win consumer confidence, particularly in the US market where EV penetration rates are among the lowest in the world.

“In NCM batteries, a 20ppm variation either way in the iron content means failure,” the analyst said.

Oil expertise

Ultimately, the DLE challenges could set the stage for large companies with tremendous experience pumping, processing and reinjecting fluids to come to the fore and break into the lithium industry. This is the hypothesis posited by a Financial Times article this past weekend.

It said ExxonMobil, Schlumberger, Occidental Petroleum and Equinor are exploring if their core skills can be used to process lithium from unconventional brine resources.

A move into alternative energy sources for oil and gas companies would be a logical diversification, particularly as they are being urged to do more to contribute towards the decarbonisation of the global economy. They have the scientific and engineering capacity, and financing resources to research and develop DLE solutions.

The main question for the oil companies is whether the prize is worth the effort, given that the lithium industry is a drop in the barrel. The Financial Times estimated lithium could grow to a US$150B/y market, dwarfed by the $2.6T oil market.

MORE FROM SKARN

About Us

Skarn Associates is the market leader in quantifying and benchmarking asset-level greenhouse gas emissions, energy intensity, and water use across the mining sector.