At around 50% of global production and growing each year, Indonesia is currently the world's largest source of nickel, a key commodity required for decarbonisation. This article examines the outlook for Indonesian nickel production, providing an overview and a forward-looking outlook.

Overview

Typically nickel products are split into 2 classes. Class 1 is for high grade products, e.g. for use in battery technologies. Class 2 products include both ferronickel (FeNi) and nickel pig iron (NPI). Class 2 nickel is commonly used as an alloying metal in stainless steel production, its use therein being the single largest consumer of nickel units. Indonesian nickel ores are typically in the form of laterites, both saprolite and limonite. Laterite's typical red colouration (from which it is named) is due to the presence of iron oxides. Lateritic soil sequences are formed from the weathering of rocks in circumstances conducive to leaching and oxidation; limonite is formed higher up in the sequence, with saprolite lower in the orebody. Indonesian nickel ore grades for limonite are generally in the range of 0.8% to 1.5%; for saprolite they may exceed 1.8%.

In Indonesia, laterite ores occur in laterally extensive orebodies close to surface, so are amenable to open pit extraction. While open pit mining is relatively cheap (on a $/tonne ore mined basis) vis-a-vis underground mining, it can have more negative environmental impacts than underground mining, for instance more extensive deforestation.

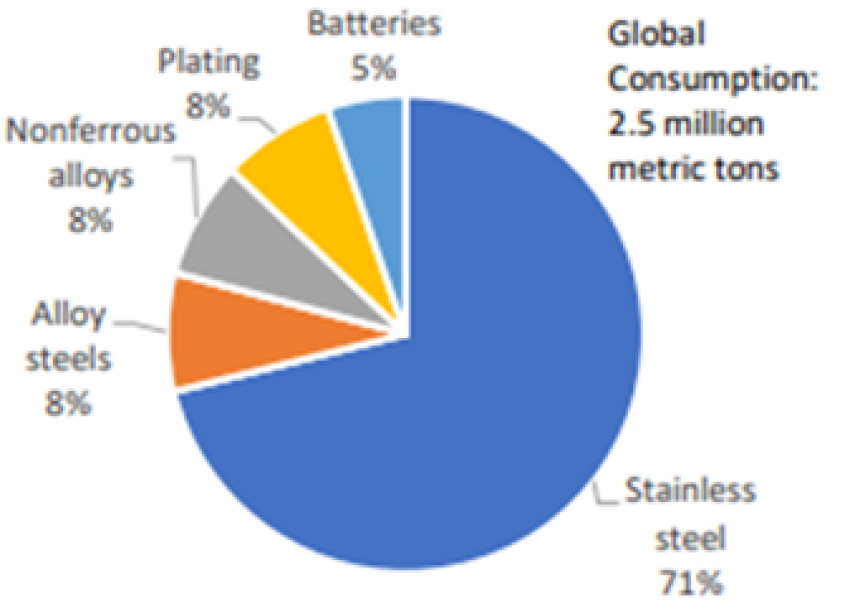

Fig.1 Global primary nickel consumption by application

Source : US International Trade Commission, Executive Briefings on Trade, May 2021

Domestic coal is widely used in the drying and initial reduction (in kilns) of all forms of Indonesian nickel ore. Indeed, as the third largest producer of coal globally (largely lower grade coal that burns inefficiently), there is a non-trivial economic incentive for Indonesia to continue to utilise coal, providing an additional domestic market for local producers, both in the private sector and state-owned.

Decarbonising the industry by moving away from thermal to renewables-based power plants and specifying this for new nickel beneficiation projects is possible. Whether this occurs any more than at the margin depends on whether powerful, state and private, coal mining interests can be overcome. Such a thesis is currently unproven.

Even so, a number of solar and wind projects have been proposed, and there is evidence of a gradual transition from coal to gas fired power, e.g. the Bahodopi nickel plant at Morowali, switching from one form of fossil fuel to another - albeit with generally lower levels of GHG emissions (assuming fugitive methane emissions are not excessive). Thus far and for the foreseeable future, coal-fired thermal power still predominates.

Process and Technologies

Since laterite ores are not generally amenable to significant upgrading by mineral processing techniques, saprolite is treated pyrometallurgically, typically by the Rotary Kiln Electric Furnace (RKEF) process.

RKEF treatment produces either FeNi or NPI or, but less commonly in an Indonesian context, nickel matte through the addition of sulphur. Each production line of the RKEF process consists of two rotary kilns and an electric furnace. The first kiln is for drying of the ore, the second completes the drying process and reduces the ore too. Finally, nickel (and iron) can be separated from the slag.

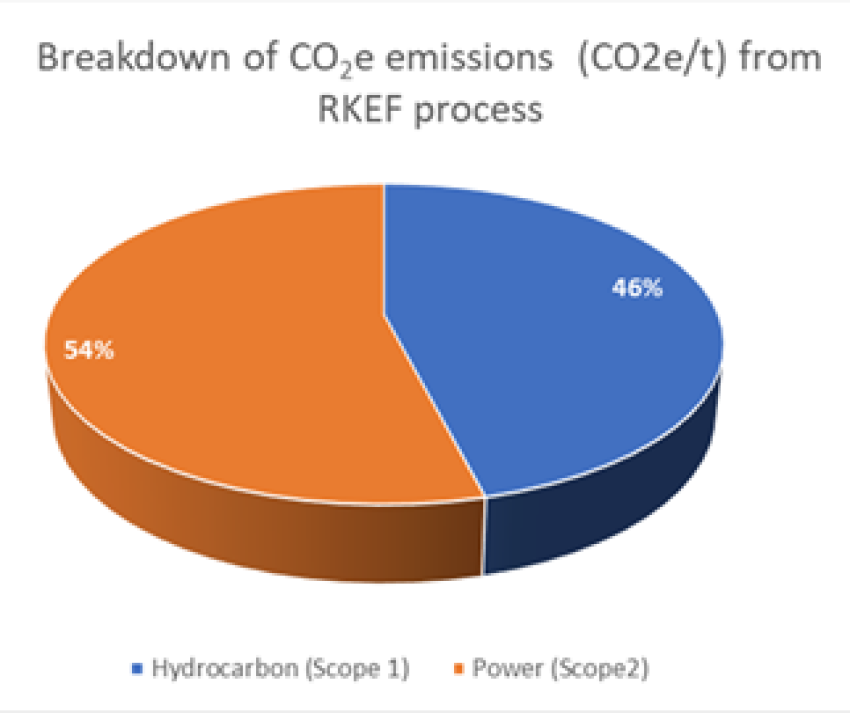

Fig. 2 Breakdown of carbon dioxide emissions from RKEF processes

As a positive development, the Bahodopi nickel plant noted above is an RKEF plant and would use natural gas-fired, not coal-fired, power. Whereas both laterite ores can be processed in a blast furnace, limonite can instead be processed utilising hydrometallurgical technology, obviating resulting GHG emissions.

In the case of limonite, and as an alternative to RKEF, hydrometallurgical technologies such as High-Pressure Acid Leaching (HPAL) can be applied to process nickel through collection of its precipitates, e.g. from Mixed Hydroxide Precipitates (MHP) containing nickel (and also iron). MHP can be refined to give Class 1 nickel products, or it can be processed directly into nickel sulphate for use in battery cathodes.

Whereas HPAL technologies have traditionally under-performed against their commercial promise, recently improvements in their design and operation have resulted in their greater level of competitiveness.

However, Indonesian nickel production is mostly high GHG-emitting Class 2, for use in stainless steel production.

Development Pathways

The likelihood of progress in ameliorating levels of future Indonesian GHG emissions in its nickel production is linked, in turn, to competing modes of its economic development and trade.

One of those modes, namely partnership with PR China, is dominating that competition; in November 2022, it was reported that there were 148 furnaces in operation, of which 137 had some form of Chinese investment. In December this was reported to have risen to 144 out of 155, i.e. all 7 of the additional furnaces reported that month were China-backed.

Indonesia is a subsoil resources-rich developing country governed by a unitary state. In common with many such countries globally, the maximising of in country mineral beneficiation and local content inputs are facets of both government policy and regulation. In Indonesia, these linked policy aims are buttressed by an export ban of ores, including nickel, further forcing the issue in favour of economic on-shoring. Singularly, PR China has proven amendable to working with this Indonesian state policy objective.

Traditionally, Indonesia exported its nickel ores, e.g. for use in the production of stainless steel. However, in 2014 a ban on the export of nickel ore was imposed, reimposed in 2020 after a brief relaxation hiatus dating to 2017. After that reintroduction in 2020, some European steelmakers challenged the export ban through the World Trade Organisation (WTO). This WTO process remains unexhausted, of indeterminate outcome since the Indonesian government has challenged the initial legal victory achieved by the Europeans.

In contradistinction, China has invested since 2014 in in-country nickel beneficiation, ensuring the security of supply through alignment with the host country government. The reduction in GHG emissions through adopting net zero energy supply, and phasing out thermal power, in Indonesian nickel production has not demonstrably been a high priority for Chinese investors. This is in line with the general Chinese policy of non-interference in such domestic energy choices.

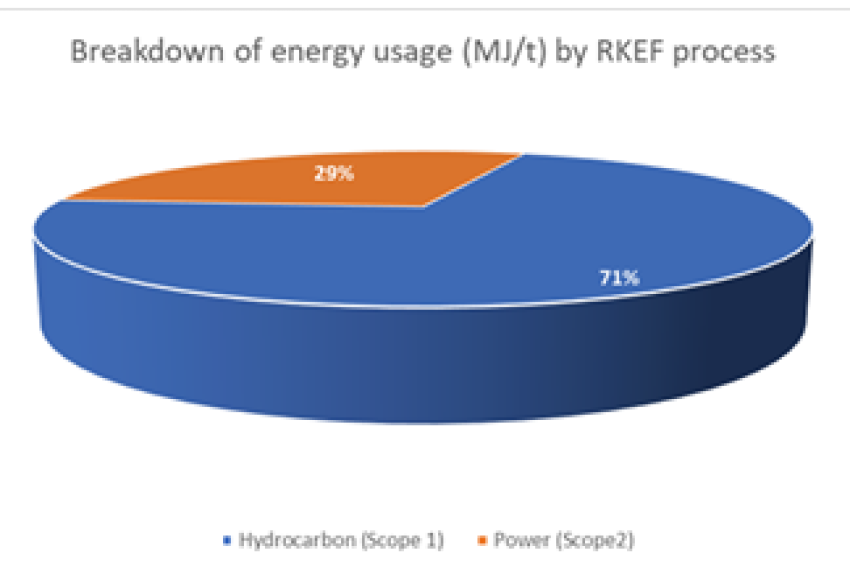

Fig 3. Breakdown of energy by RKEF process

A breakdown of energy by RKEF processes indicates the dominant impact of hydrocarbons, in particular coal see figure 3 below.

A typical Indonesian RKEF plant emits around 7-8t CO2e/t alloy product (60-70t CO2e/t Ni Eq.) whilst processing saprolite ore. Potentially however this could be substantially improved if power was drawn by renewably sourced power plants. Whereas this may be an ESG investment driver for (some) European investors, less so for China. Limonite processing via HPAL would give a substantial improvement in CO2 emissions (albeit ESG issues remain live with respect to HPAL leached residues), with emissions intensity of around 10-20 t CO2e/t Ni Eq., driven by power usage. Again, in Indonesia and even for limonite ores, pyrometallurgical nickel beneficiation, not HPAL, remain the norm.

Outlook

The Indonesian Nickel Mining Association (APNI) forecast that for 2023 was that 199 furnaces would be in operation at 43 plants. Of these 38 would be pyrometallurgical operations consuming high-grade ore. For 2025, they foresee a substantial increase to 136 operating plants, but only 10 of these would be for hydrometallurgical projects. The implication is that highly-GHG emitting RKEF will remain the norm for nickel production in Indonesia.

In the specific case or nickel matte projects, the outlook once again reflects the fact of Chinese investment/ developmental partnership with Indonesia. Strikingly, of all the nickel matte projects currently identifiable as being in development pipeline, each appear to involve one (Chinese) company: CNGR Advanced Materials Co Ltd (CNGR). CNGR are proponents of using the Oxygen Enriched Side Blowing Furnace (OESBF) process to make matte.

This technology has been used successfully in copper, lead and zinc production in China. It is likely that the OESBF would obviate a significant part of the energy usage of the RKEF plus converter route to matte by removing the electric furnace and converter steps; hence reducing GHG emissions.

The kilns would still be necessary to dry the feed ores. It would also allow low grade saprolite and limonite to be processed to make matte or even NPI. The latter option potentially offering an option of supplying NPI, as well as battery raw materials, as the reserves of high grade saprolite become depleted.Overall, the above trend implies a significantly lower, yet still highly elevated, level of GHG emissions specified to nickel matte production, noting that power for OESBF would be largely coal-fired too.

Conclusions

Regarding nickel-beneficiation GHG emissions, the Indonesian outlook indicates limited signs of optimism, for instance with respect to a limited limonite ore beneficiation transition from RKEF to HPAL processes and considering the OESBF example above, amongst the prevailing gloom. Overall, high levels of GHG emissions can be considered the likely future, not just current, norm for Indonesia, as the country - and its Chinese partners - pursue economic and commercial objectives that seemingly remain their primary concern.

The below quote reflects the overall prognosis of highly nuanced optimism, such that it exists, regarding the ESG outlook for Indonesian nickel production - and its limitations. The Indonesia Nickel Miners Association (APNI)'s General Secretary, Ms. Meidy Katrin Lengkey, stated that the Indonesian government is

"..giving investors the opportunity to build hydrometallurgical plan to support the electric vehicle battery program"

but only "reportedly" and only "seeing how massive the pyrometallurgical plant is". That is, a window to invest the form of Class 1 nickel beneficiation amenable to non-fossil fuel HPAL technology is described almost as a concession to ESG-conscious investors, against the wider backdrop and far larger scale of what - by implication - really matters to Indonesia as a mining nation, namely coal-fired powered pyrometallurgical production of Class 2 NPI for stainless steel production.

Overall, high levels of GHG emissions can be considered the likely future norm for IndonesiaAuthor: Dr John Anderson, Principal Consultant, Metallurgical Analysis

MORE FROM SKARN

About Us

Skarn Associates is the market leader in quantifying and benchmarking asset-level greenhouse gas emissions, energy intensity, and water use across the mining sector.