Mexico has passed amendments to its mining law, the National Waters Law, the General Law of Ecological Balance and Environmental Protection and the General Law for the Prevention and Comprehensive Management of Wastes, creating a moment of uncertainty for the mining sector. The changes will see companies held to higher environmental standards and protections, increasing environmental aspects as a risk factor in the near term as companies adjust.

The laws create a water concession for mining use, and companies will have to bid for water allocation. Water rights can no longer be transferred under the new laws. The good news is that water concessions will last for the same term as the underlying mining concession.

Companies will have to submit monthly water consumption reports, and face a reduction in water volumes in times of water availability risk. Holders of water concessions will have 90 days to modify them from industrial use to industrial use in mining.

The new laws include tougher end of life obligations and the disposal of mining waste. Companies will have 365 days to submit the authorisation of their restoration, closure and post-closure programme. "Closure requirements are only generically defined. For example, the requirements for waste rock characterisation during mining operations is insufficient for defining potential long-term environmental risk for acid drainage" Patrick Williamson, Principal Hydrogeochemist at Colorado based Intera told Skarn Bulletin.

Upon being awarded a concession, a company will have to obtain a social impact authorisation, a mine closure and restoration plan authorisation, a water concession for industrial use in mining and provide a bond to respond for possible damages before a concession title is handed over.

Some changes will serve to bring Mexico more in line with the requirements miners face in other jurisdictions. "Bonding or security requirements for mine closure are common elsewhere and provide funds to properly close a mine regardless of changes in ownership. A properly structured closure bonding process encourages the philosophy of mining towards closure, which includes best industry practices for baseline studies, ongoing monitoring during operation, and mine waste management to possibly decrease the bonding investment over time and ensure the mine can be closed within the existing closure budget," said Williamson.

New rules

A raft of new changes need to be regulated including reduced concession terms, changes to water permitting and environmental bonds following the passing of new laws. "What is being worked out now between the government, industry bodies and companies is how these laws will be governed and what processes need to be put in place to make the intent practicable," George Paspalas, President and CEO of MAG Silver told Skarn Bulletin.

Legal challenge

The caveat is that the government faces legal challenge to almost all the bills on the grounds of procedural irregularities. The Senate approved them without discussion, on April 29, passed by the president's political party and allies outside the Senate, without the presence of the opposition. The Supreme Court of Justice has already thrown some out. "We have identified several provisions in the bill that we believe contravene the constitution and are therefore working with litigators to prepare constitutional suits against the law," Rodrigo Sanchez, a partner at Sanchez Mejorada Velasco y Uribe told Skarn Bulletin.

Skarn Water's Raymond Philippe explains: As published in a recent article in Mexico's El Financiero this new ruling would mean that in the north of Mexico, only projects that will source their water supply from municipal or industrial wastewater, or even desalinated seawater, will be able to obtain approval.

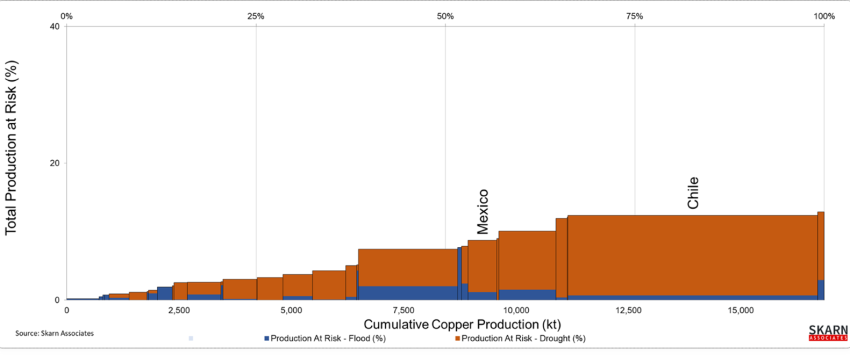

The level of water stress for the mining industry in Mexico is not to be underestimated. Based on Skarn Water research, physical water-related factors have currently close to 10% of Mexico's copper output at risk. As can be seen in the graph below, this level of water-related risk is currently just under the water stress in Chile. The main difference though is that Chile has been preparing for some time now to build more resilience with the incorporation of seawater as an alternative water supply source.

And even though this push on Mexican mining to change its water supply source is now becoming real, experience has learned that it may take anywhere between 5 to 10 years to get through the process of design, permitting, tender and finance up to construction and water delivery to site.

On the other hand, Mexico's copper mines are processing lower grade ores than most other countries, this means the water consumption per tonne of copper output for Mexican mines is generally higher than in other countries. The cost of water from alternative supplies, such as desalination, may become an important economical factor to take into consideration.

Mexico's mining sector will be facing a complex outlook, and possibly will have to become very proactive to avoid accumulating production losses in the medium term.

MORE FROM SKARN

About Us

Skarn Associates is the market leader in quantifying and benchmarking asset-level greenhouse gas emissions, energy intensity, and water use across the mining sector.